child tax portal update dependents

Click the blue Manage Advance Payments button. Heres how they help parents with eligible dependents.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

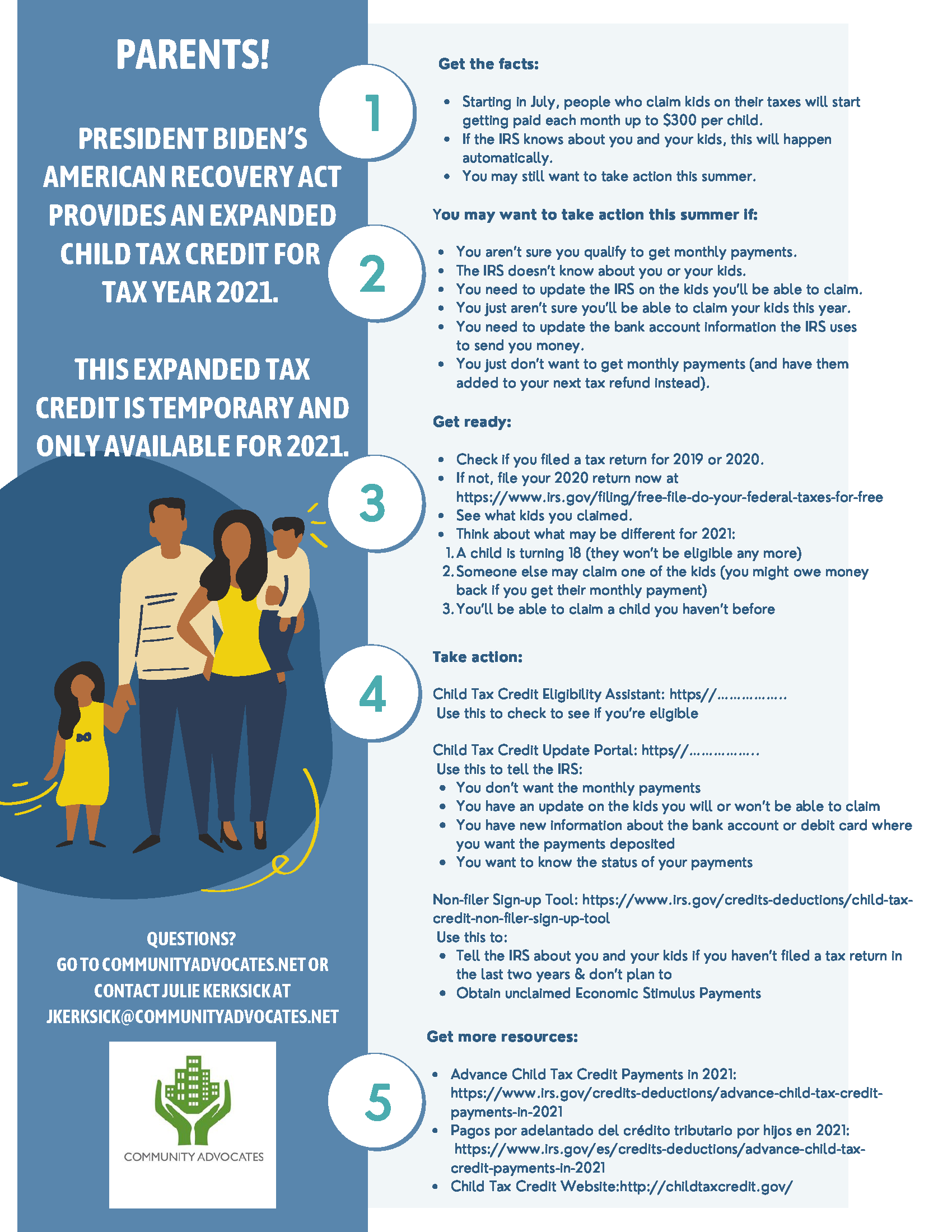

Here is some important information to understand about this years Child Tax Credit.

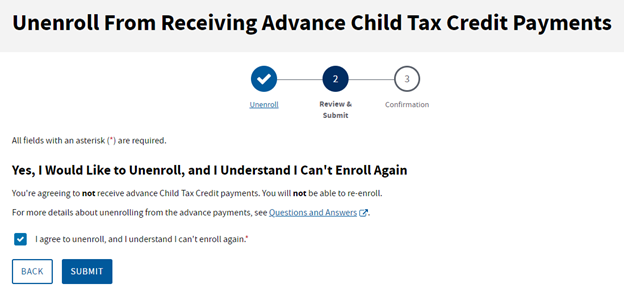

. See Q F3 at the following link on the IRS web site. The timeframe for receiving advance payments of the Child Tax Credit CTC during 2021 has expired. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

Half of the money will come as six monthly payments and. FAMILIES can now use an online portal to claim up to 3600 per child in advance child tax credits. If you are already receiving the maximum amount a decrease in your 2021 income.

The Biden administration has initiated the new online portal to ensure low-income parents that didnt file tax returns can get their hands on the credits. The Child Tax Credit Update Portal and Child Tax Credit Non-filer Sign-up Tool mentioned in this section have now been closed and are unavailable. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return.

Generally you can expect to receive up to 300 per qualifying child under age 6 and 250 per child ages 6 to 17. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. Getty While it has limited features at the minute there are plans to roll out more functions later this month including updating the ages of your dependents your marital status and your income.

All taxpayers who received advance payment s of this credit must file a tax return to claim the CTC and. The Child Tax Credit provides money to support American families. The IRS will pay 3600 per child to parents of young children up to age five.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The Child Tax Credit Update Portal is no longer available. Heres how they help parents with eligible dependents.

The update to the online portal allows families to quickly and easily update their mailing address via the already existing Child Tax Credit. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. It also made the.

Heres how they help parents with eligible dependents. Parents can now use the Child Tax Credit Update Portal to check on their payments Credit. The Update Portal is available only on IRSgov.

With the new portal families can claim up to 3600 per child younger than six and up to 3000 for each child aged. Visit the IRS website to access the Child Tax Credit Update Portal Go to httpswwwirsgovcredits-deductionschild-tax-credit-update-portal. So should a new parent qualify for the Child Tax Credit payments they can receive the full 3600 tax credit which is split between monthly payments and a lump sum claimed on your 2021 taxes.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. You can no longer view or manage your advance Child Tax Credit. The Update Portal for adding a dependent is not available yet.

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Child Tax Credit Update Irs Launches Two Online Portals

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What We Do Community Advocates

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Info For Foster Parents Fpaws

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What To Know About New Child Tax Credits Starting In July Nbc 5 Dallas Fort Worth

Can I Claim My Elderly Loved One As A Dependent On My Taxes Tax Deductions Types Of Taxes Deduction